Scammers, the tapeworms of the digital age. The absolute bottom-of-the-barrel, pond-scum-dwelling, mouth-breathing con artists who spend their days preying on the gullible, the vulnerable, and the technologically illiterate. They are, quite simply, a waste of oxygen. The people who wake up every morning, rub their hands together, and think, Right, whose grandma am I stealing from today? They are the absolute worst—right up there with people who chew with their mouths open and those who describe themselves as an “empath” while being an unbearable narcissist.

Now, scamming isn’t new. It’s been around since the first caveman convinced another that this rock was worth three of those rocks. But back then, at least the con artists had to put in some effort. These days, all they need is a cheap laptop, a broken moral compass, and a WiFi connection stolen from their neighbor.

And oh boy, they come in waves. One minute, it’s a Nigerian prince who has tragically lost access to his millions but, in an incredible stroke of luck, has chosen you—yes, you, Doris from Richmond—to help him. All you need to do is send your bank details, and soon, you’ll be rolling in cash. Astonishing. Almost as if… it’s complete nonsense.

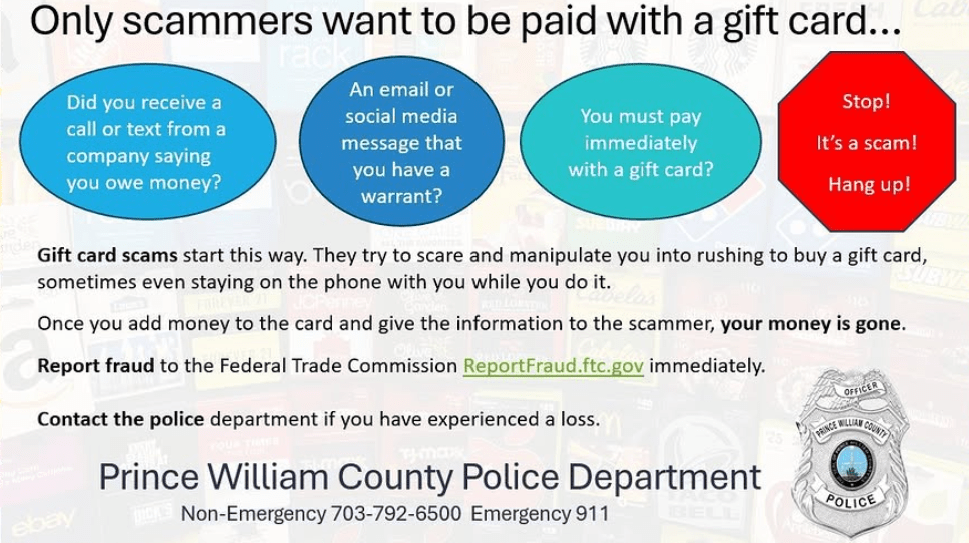

Then there’s the IRS phone scam, where some guy with a very distinct South Asian accent introduces himself as Richard Wilson and tells you that you owe thousands in taxes. Which is weird, because when did the IRS start exclusively hiring people named Brian, Kate, Steve, and Kevin who all just happen to be based in a very noisy call center in Mumbai? And, even more fascinatingly, since when did the U.S. government start accepting Target gift cards as an official form of tax payment? Somewhere in Washington, a confused IRS agent is wondering why people keep mailing in vouchers for discounted PlayStations instead of actual money.

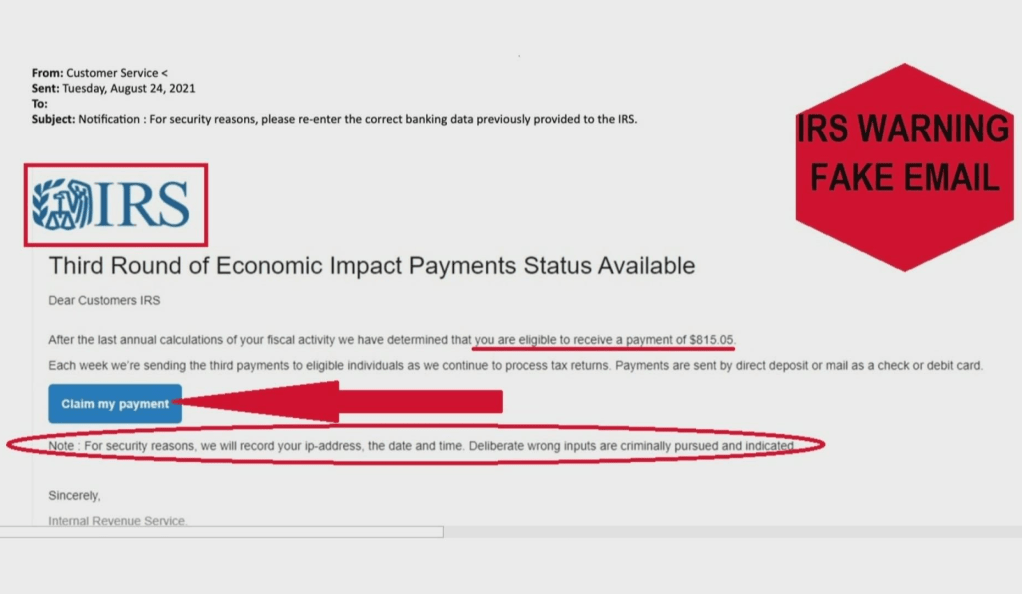

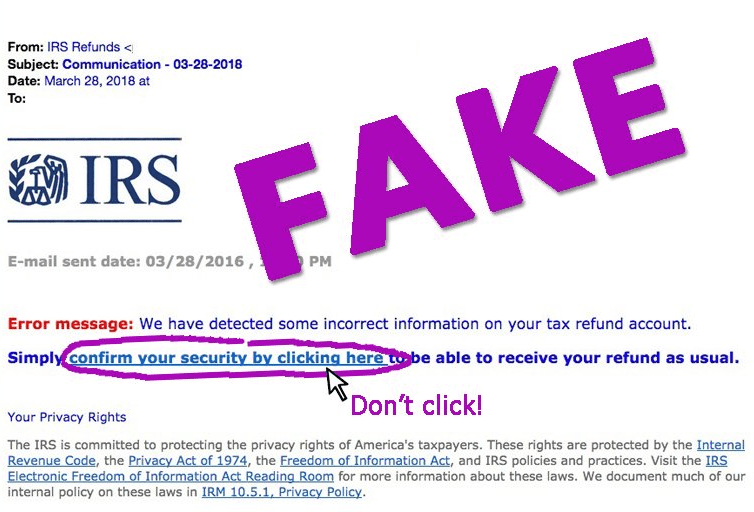

And of course, let’s not forget phishing scams—those emails pretending to be from your bank, PayPal, or sometimes even the FBI. They all follow the same formula: first, an urgent subject line screaming that your account has been locked. Then, a frantic message telling you to click a very suspicious-looking link. Finally, a demand to enter your login details, which, obviously, will go straight into the hands of a scammer named Rajesh, who now has full access to your savings and will be using them to buy himself a rather nice new watch. Your bank, by the way, is not going to email you at two in the morning in all caps, threatening you like an ex who just found out you cheated.

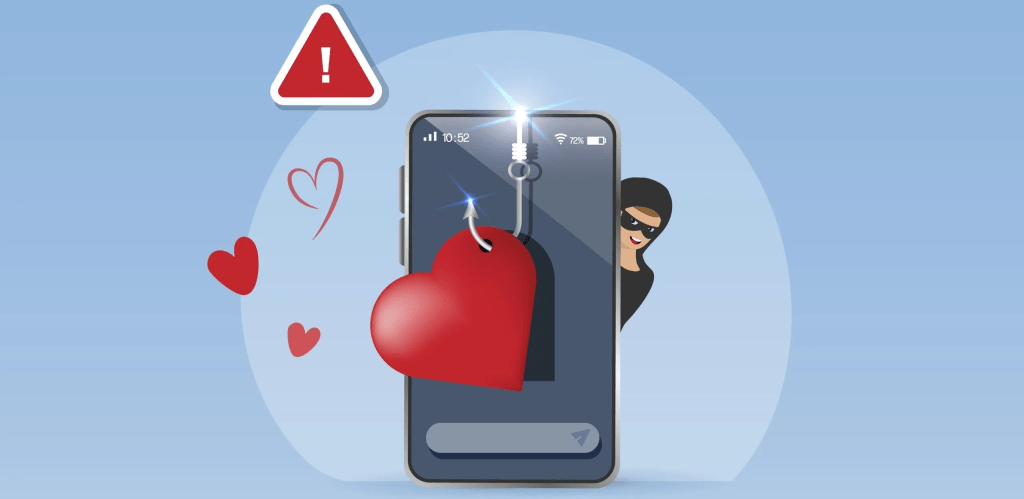

Then we have romance scams, where scammers pretend to be an attractive, mysterious stranger—often a military officer or a successful businessman stuck overseas. They whisper sweet nothings, shower you with affection, and then—surprise!—need money for a visa, a plane ticket, or a tragic emergency involving their poor sick grandmother. Who, incidentally, has been dying for the last seven years. Shockingly, people fall for this nonsense, sending their life savings to someone who, in reality, is probably an overweight man sitting in a dimly lit basement, eating instant noodles while juggling 20 fake Tinder accounts.

Investment scams are another classic, always featuring some shady character promising to turn your $500 into $50,000 through a “secret” trading method. Which, by the way, if it actually worked, why are they still hustling people on Instagram instead of living in a mansion? These scams often come with an aggressive sales pitch, warning you that this is a “limited-time opportunity” and you must act now, because nothing says “trustworthy financial opportunity” like the exact same tactics used by questionable used-car salesmen.

But my absolute favorite has to be fake product scams. You’ve seen them. The magic fat-burning pills that promise to melt away 50 pounds overnight. The miracle cream that will erase wrinkles in seconds. The revolutionary anti-virus software that—ironically—is actually a virus. If these products worked, we’d all be billionaires with six-packs by now.

At the end of the day, avoiding scams comes down to basic common sense. No, a Nigerian prince is not giving you money. No, the IRS does not accept gift cards. No, Microsoft is not calling you out of the blue. No, someone you’ve never met online does not love you. And no, a magical investment that “guarantees” profits does not exist. If it sounds ridiculous… it probably is.

Leave a reply to shadowydelicately8f9ec7fef1 Cancel reply